You may have seen headlines recently discussing the rise in average house prices around the UK. Indeed, the Office for National Statistics reports that the average house price in March 2023 was £285,000 – £11,000 higher than they were 12 months prior.

Rising house prices are making it tough for first-time buyers, with This is Money reporting that average property values for first-time buyers are now around 7.6 times the average UK salary, and the average deposit is £62,500.

One of the solutions that can help first-time buyers to afford to get onto the ladder is a mortgage with a longer term, aptly called an “ultra-marathon” mortgage.

These new marathon mortgages can run for up to 40 years, meaning you benefit from lower monthly repayments as the debt is spread out over a longer term.

While these “ultra-marathon” mortgages may seem like a fantastic idea, especially during the cost of living crisis, there are some important considerations to take into account. Continue reading to discover how long-term mortgages work, and how you could end up owing more interest to your lender overall.

Ultra-marathon mortgages have terms of up to 40 years

An “ultra-marathon” mortgage is simply a loan with a repayment term of 35 years or longer. Until recently, mortgages with terms longer than 25 years were somewhat uncommon, though they have grown in popularity in the past few years, particularly with first-time buyers.

Indeed, This is Money reports that nearly 1 in 5 first-time buyers now take out mortgages with a term of 35 years or longer, an increase from 1 in 10 just a year ago. The same source also reports that the number of people taking out mortgages with 30- to 35-year terms rose from 34% to 38% during the same time frame.

Perhaps the most significant benefit of a longer mortgage term is the lower monthly repayments.

According to MoneyHelper’s mortgage calculator, if you bought a £250,000 property on a 90% loan-to-value (LTV) capital and interest mortgage with an interest rate of 5%, you’d pay £1,315.33 a month on a 25-year term.

With the same mortgage over a 30-year term, monthly repayments would drop to £1,207.85. Increase the term even further to 40 years and repayments fall to £1,084.94 a month.

As you can see, extending the term of your mortgage could result in substantially lower mortgage payments, which may give you much-needed breathing room each month. Better yet, a longer-term mortgage could even help you pass a lender’s affordability assessment, as you are more likely to be able to prove you can afford these lower repayments.

You could owe the lender more interest in the long run with an ultra-marathon mortgage

Although taking out your mortgage over a longer term means you will lower your monthly repayments, it’s important to note that you could incur more interest over time. This is Money gives a fitting example to show how interest climbs with longer-term mortgages.

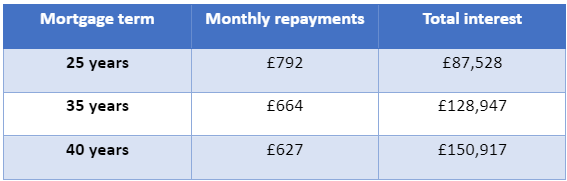

The table below shows the monthly repayments and total interest on a £150,000 capital and interest mortgage with a 4% interest rate.

Source: This is Money

As you can see, while you would pay less each month on a 40-year mortgage compared to a 25-year one, the total interest you owe would ultimately rise by £63,389 in this example.

Ultra-marathon mortgages also carry an additional risk of negative equity. This is simply when the size of the outstanding mortgage is more than the value of your home.

Since most of your payments in the early years go towards interest, you will have paid off relatively little of the amount you borrowed. This could mean the property becomes challenging to sell if the loan size exceeds the property value, or you could find it tricky to remortgage in future.

Also, if your ultra-marathon mortgage lasts into your 60s and beyond, this could affect your retirement plans since you’ll still be paying off your mortgage. This increased financial burden could potentially affect your living standards in later life.

It’s worth noting that many lenders have a borrowing age cap on mortgages, and you could find you’re restricted from accessing certain products depending on your age.

For example, if a lender has a maximum age of 75, you wouldn’t be able to take out an ultra-marathon 40-year mortgage in your 40s or 50s.

Get in touch

If you’re considering taking out a longer-term mortgage, speak to us. We can help you understand your options, the repayments you may face over a range of terms, and find the right mortgage for you.

To discuss this more, please email enquire@london-money.co.uk or call (0207) 808 4120.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Think carefully before securing other debts against your home.