In recent months, a variety of factors have combined to create a surge of growth in the housing market. According to the Office for National Statistics (ONS), the average price for a house in the UK is now £251,000, which is an increase of 8.9% in the year to April 2021.

If you’re trying to get onto the property ladder, it can feel like a daunting task to save up enough for a mortgage deposit. This fact has led many young people to wonder if it might be a better idea to rent in the long term, rather than buying.

While this may seem like a good idea initially, you may find that there are more benefits to owning your house outright. Read on for five practical reasons why you should buy your home instead of renting.

1. Your home is an investment

One of the main reasons to buy your home is that it is a long-term investment. With every monthly payment, you are one step closer to paying off your loan, rather than simply paying your landlord.

As we mentioned earlier, the UK housing market has seen strong growth in recent months, despite the economic shock of the coronavirus pandemic. According to a report by Halifax, published in the Guardian, house prices have grown by £22,000 in the year to May 2021.

Furthermore, according to the report by Halifax, it is likely that this growth will continue for some time.

When you come to sell your house, it is likely that it will have increased in value and so you will eventually be able to make a profit from the sale. If you do, you could then use this to upsize to a larger home, or one in a different area.

On the other hand, if you had chosen to rent for the same amount of time, you would have nothing to show for it.

2. You can alter the property however you like

Another benefit of owning your own home is that it is yours to do with as you please. When you rent, since you don’t own the property, you are often unable to properly alter it to your liking.

For example, if you care about the environment then you may want to make your home as energy efficient as possible to reduce your carbon footprint. This could also have the added benefit of reducing your utility bills.

If you were buying the property, you would be able to make whatever changes you liked, such as installing double-glazing or fitting cavity insulation.

However, if you were renting, your landlord would likely have to pay for these modifications instead. Given that the cost of installing double glazing on a home can cost several thousand pounds, they might be reluctant to do so.

Owning your home can give you a greater sense of control, which can help you to feel more comfortable and satisfied with the property.

3. You can stay in your home as long as you want

Another significant benefit of buying your own home is that you don’t have to worry about the risk of your landlord suddenly asking to end the tenancy.

Buying your home offers more security than renting, which can help you to feel more comfortable. Having the thought in the back of your mind that you might have to move home at any time can make it hard to get attached to a property.

If your landlord were to end the tenancy, you may get a few weeks’ notice, but this isn’t a long time to pack up all your belongings and find new living arrangements.

When you buy your home, you can feel more secure that, as long as you continue to pay your mortgage, you won’t have to worry about being forced to move at short notice.

4. It is often cheaper in the long term

While you would initially have the large expense of your deposit, one benefit of buying your home is that making mortgage payments can often be cheaper than paying rent in the long term. This can give you more disposable income to spend on things you enjoy.

The reason for this is simple. Your landlord will charge you rent at a rate which covers their costs and then some extra so that they can make a profit. If you were only paying for your mortgage, then your monthly payments may be lower.

Furthermore, there are a wide variety of fixed price mortgages that you can get. This means that you know your monthly payments will remain constant for several years.

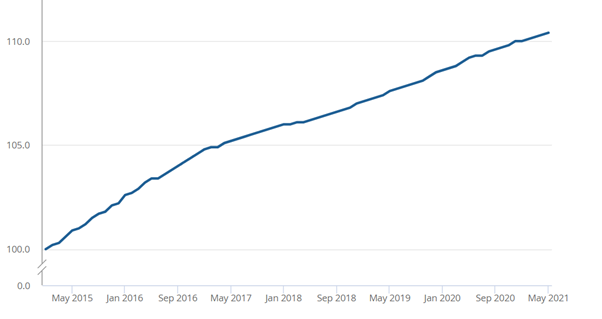

Rent prices, on the other hand, can, and often do, increase annually. According to figures from the Office for National Statistics (ONS), rents have increased by around 10.4% since 2015, as you can see on the graph below.

Source: ONS

Note: Index values (January 2015 = 100)

5. It can give you a sense of stability

When you buy a property, it can give you a strong sense of financial stability. Not only can you fix your monthly payments if you want to, but you also have a clear goal to work towards.

If you live in a house for many years and have been paying your mortgage for the whole time, eventually it will be completely yours. If you were renting for that period, you would have nothing to show for it.

Furthermore, owning your home can be useful when you come to retire, as you won’t have rent payments eating into your pension savings.

If you want to gain more stability by buying your home instead of renting, you could benefit from speaking to a professional. Working with a mortgage broker can help to find the right mortgage product for you, making the buying process faster and easier.

Get in touch

If you’re struggling to get onto the property ladder and want to know how working with a professional can help you, get in touch. Email enquire@london-money.co.uk or call us at 0207 808 4120 to find out more.

Please note:

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.