Since the start of 2021, the Bank of England (BoE) has increased the base rate 14 consecutive times to its current level of 5.25% (as of 10 October 2023). This has had a knock-on effect on mortgage rates, causing them to rise significantly.

As a result, many borrowers across the UK are feeling additional financial pressures and are seeking ways to reduce their monthly mortgage costs.

If you find yourself in this situation, one of the ways you could potentially reduce costs is by applying for a longer-term mortgage – sometimes called a “marathon mortgage” – or extending the term of your existing deal.

Interestingly, it seems as though longer-term mortgages have become more prevalent in recent years.

Indeed, Moneyfacts reveals that 68% of the residential mortgage market accommodates a maximum term of 40 years, a rise from 57% last year.

However, before you apply for a longer-term mortgage or extend the term of your existing deal to reduce costs, it’s worth taking note of several important caveats.

Continue reading to discover why long-term mortgages have become more popular recently, and some notable benefits and downsides.

A higher cost of borrowing could be the reason longer-term mortgages are more prevalent

In recent years, “marathon mortgages” – those lasting up to 40 years – have become more commonplace. This surge in long-term mortgages can be attributed to several factors, namely rising property prices, climbing mortgage rates, and the increased cost of living.

Data reported by Statista reveals that the average two-year fixed-rate mortgage stood at 1.18% in September 2021, rising to 4.51% as of May 2023. This has seen repayments rise for millions of borrowers.

Taking out a mortgage over a longer term means you can spread your repayments over an extended period, bringing the monthly cost down. In a world of high inflation and a rising cost of living, this has helped many homeowners to maintain their repayments at an affordable level.

Longer-term mortgages could be especially beneficial for first-time buyers

A “perfect storm” of high living costs and climbing property prices means that long-term mortgages could be especially useful for first-time buyers.

Take rising property prices, for example. Data reported by Statista shows that the average house price in the UK in January 2023 was £286,489, a rise from £231,940 in January 2020.

To deal with these higher costs, a long-term mortgage could make it easier for you to pass a lenders’ affordability checks. Taking a mortgage out over a long term typically reduces your monthly repayments, making it more likely that you can afford the loan alongside your other commitments.

The Guardian reveals that the number of first-time buyers opting for a mortgage term longer than 35 years more than doubled in 2022 to 17%. Even the number of borrowers taking out a mortgage between 30 and 35 years increased from 34% to 38% during the same period.

While a longer-term mortgage could help reduce costs, is it worth applying for one yourself or extending the term of your existing home loan? Read on to discover the benefits and downsides of doing so.

You could lower your monthly payments with a longer-term mortgage

As mentioned, perhaps the most significant benefit of a long-term mortgage is that you could benefit from lower monthly payments.

Consider a £250,000, 75% loan-to-value (LTV), capital and interest mortgage (that is £187,500) at an interest rate of 5%. According to MoneyHelper’s mortgage calculator, the different monthly costs you’d pay across different term lengths are:

- £1,096 a month over 25 years

- £1,007 a month over 30 years

- £904 a month over 40 years.

As you can see, the above mortgage over 25 years compared to 40 years would see you paying £192 less each month. These lower payments could give you much-needed breathing room each month, especially at a time when living costs are already high.

You may end up paying more in interest overall with a long-term mortgage

It’s important to note that, while you can reduce the amount you pay monthly towards your mortgage with a longer-term deal, you’ll typically pay more in interest overall.

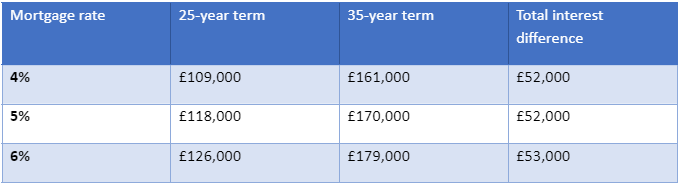

The table below shows the amount of interest you’d pay over extended terms if you were to buy a property for £250,000 – the average UK property price – with a 25% deposit (borrowing £187,500), based on a fixed-rate capital and interest mortgage reverting to 4% after four years.

Source: Zoopla

As you can see, taking this mortgage over 35 rather than 25 years will see you pay more than £50,000 in additional interest over the term of the loan.

Moreover, a long-term mortgage can also carry an additional risk of negative equity. This is when the size of your outstanding mortgage is more than the value of your home.

This occurs because, since most of your payments in the early years would go towards interest, you’ll have paid off less of the amount you initially borrowed. As a result, if property prices were to fall, your property could become challenging to sell, or you may struggle to remortgage later in the future.

It’s also essential to remember that if your mortgage term lasts well into your 60s, this could affect your retirement plans since you’ll still be paying it off.

This increased financial burden could mean that you need to save more for retirement. Otherwise, you could end up with a shortfall that means you can’t live your desired lifestyle when you stop working.

Get in touch

We can assess your current situation to identify whether a longer-term mortgage would be the right choice for you.

To discuss this more, please email enquire@london-money.co.uk or call (0207) 808 4120.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Think carefully before securing other debts against your home.