Many associate the holiday period with joy, love, giving, and celebration. It’s a time of year that many look forward to, filled with visits from your loved ones and uplifting decorations that line the streets of our towns and cities.

The antithesis of this comes just three weeks later. Blue Monday is considered the most depressing day of the year, falling on the third Monday of January. The Metro report that this is because of a combination of bad weather, long nights, failed new year resolutions, and festive debt.

But financial planning may be able to help, as it can often bring a boost to your mental health. But why is this the case, and is there a link between money and mind? Read on to find out more.

Mental health and finance are intrinsically linked

There is a correlation between financial difficulty and mental health troubles, with one often leading to the other and creating a cycle that is difficult to break.

This cycle could steadily get worse the more times you go through it. If your financial management ability and decision-making is affected by poor mental health, the subsequent financial issues may further deteriorate your mental wellbeing, and so on.

For example, suffering from anxiety or depression may prevent you from effectively managing your finances, be it through aversion or a lack of motivation. This could lead to overspending, since you may feel more impulsive, and shopping could bring you a brief high.

The more you spend, the better you might feel, but this high won’t last forever. You may soon realise that the decisions you made have negatively impacted your finances, and you could feel an overwhelming sense of guilt or regret when reflecting on them.

This overspending could also lead to a strain on your savings, which may leave you stressed or worried about getting through the month, leading to deeper struggles with anxiety or depression.

It could also lead to sleep loss, or even a feeling of loneliness or isolation since you are unable to afford the things you may want to do, like enjoying a meal out with friends.

Three ways financial planning can help your mental health

Since the link between finance and mental health is so strong, searching for help to improve one can often help the other too. There are several ways that financial planning could help boost your mental health, and here are three of the most effective.

1. Gives you a greater sense of confidence and control over your finances

Managing your finances can be one of the most difficult and anxiety-inducing daily tasks. Sometimes it’s hard to tell whether you’ve saved enough towards your various goals, be it an emergency fund, your pension, or just making it through to the end of the month.

This is where a financial planner could come in and help you more easily digest your financial commitments. They can help you manage your outgoing payments, formulate a spending plan, and use specialist tools such as cashflow forecasting to determine how far your money can go.

Any data they gather can then be used to adapt your existing financial plans and help draft new ones, allowing you to remain confident that you can achieve the goals you want to.

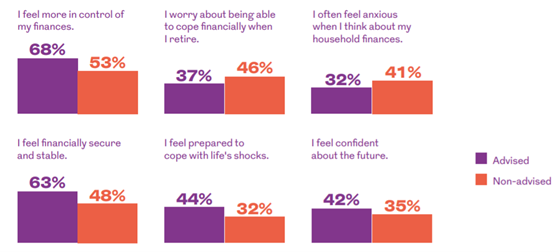

A study by Royal London shows just how much of an impact financial planning can have. It found that people who work with a financial planner feel more in control of their finances, more financially stable, and more confident than those who don’t.

2. Provides a greater understanding of financial products

Having a greater understanding of financial products or choices could lead to reduced stress levels and peace of mind. A financial planner will break down any important decisions you need to make in an easy-to-understand way.

This allows you to work with your planner more easily, since you can freely discuss the topic without knowledge barriers. This then helps you choose the option that is right for you and your situation with confidence.

Fully understanding the decisions you’ve made can later help to prevent worry or regret, help you recognise your next steps, and allow you to stay in control of your finances.

3. Regular financial advice can produce even better results

Regular contact with a financial planner can produce even better results for your finances, and thus your mental health, than a one-off chat. This is because regular contact allows for follow-up meetings where your progress and spending habits can be re-evaluated.

According to a study by the International Longevity Centre UK (ILC), those who maintained a relationship with a financial planner were able to save more in the long term.

Those who received financial advice in both 2006 and 2016 generated pension wealth worth about 50% more than those who only received advice once.

Constant contact with a planner can increase the peace of mind and confidence you feel in your finances as they are consistently reassessed over a longer period.

Get in touch

If you’d like to benefit from the expert financial advice of a professional this new year, email enquire@london-money.co.uk or call us at 0207 808 4120.